Leading Auto Lender Achieves 94% eSignature Conversion Rates on Loan Extensions & ACH Authorizations

Company

Top Auto Finance Servicing Team Seeks Continued Innovation

Westlake Financial is a respected leader in the automotive industry, servicing thousands of customers across America. The company’s growth is attributed to its adoption of innovative solutions that streamline sales and service operations.

The company’s SVP Collections, Brian Renfro was looking to harness intuitive digital tools to improve servicing while ensuring full compliance and customer satisfaction.

"We are proud of our close partnership with Lightico. Its Digital Completion technology has made an incredible impact on our operations, bottom line, and customer experience. Our collaboration is anchored in the combination of a strong business relationship and Lightico's unparalleled technological capabilities. We look forward to driving more business growth together."

Challenge

Collecting eSignatures on Loan Extensions & ACH Authorizations in Real Time

To ensure full compliance and a stellar customer experience, the servicing team needed a solution that could ensure immediate filling and signing of extensions, modifications and ACH authorizations in real-time — while the service representative was on the phone with a customer.

Westlake’s servicing team’s success relies on delivering world-class service as efficiently as possible. This includes completing servicing requirements such as quickly collecting customer signatures on loan extensions and modifications, and collecting completed ACH forms from customers.

Solution

An Intuitive, Mobile Customer Experience

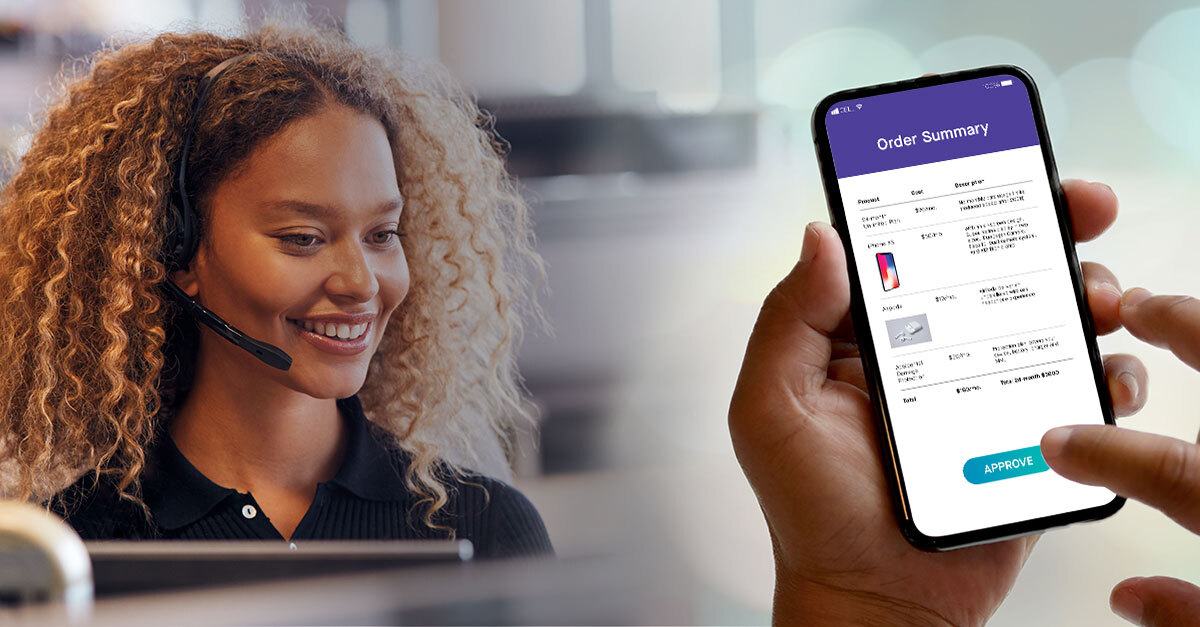

Westlake Financial implemented Lightico’s mobile-first platform to accelerate and improve service processes. The Lightico Digital Completion platform allows Westlake’s service representatives to instantly collect signatures on extensions and fully complete ACH forms via a simple text message sent to the customer’s mobile phone by the agent during a call.

Using Lightico’s intuitive interface, customers can now complete and sign forms in seconds without waiting for emails, or using a printer, scanner or fax.

Since adopting the technology, representatives no longer have to spend their valuable time chasing missing signatures and reworking incorrectly completed forms. As a result, servicing has become much more efficient and Westlake has strengthened its reputation as a leader in the automotive industry.

“Since implementing Lightico’s solution, we’ve been able to drastically improve service efficiency. Thanks to the instant, digital channel, agents are able to collect ACH forms from customers in under 30 minutes. We’re proud to be working with one of the most innovative technologies on the market to deliver world-class service to thousands of auto finance customers across America.”

Explore the products that are helping Westlake Financial grow

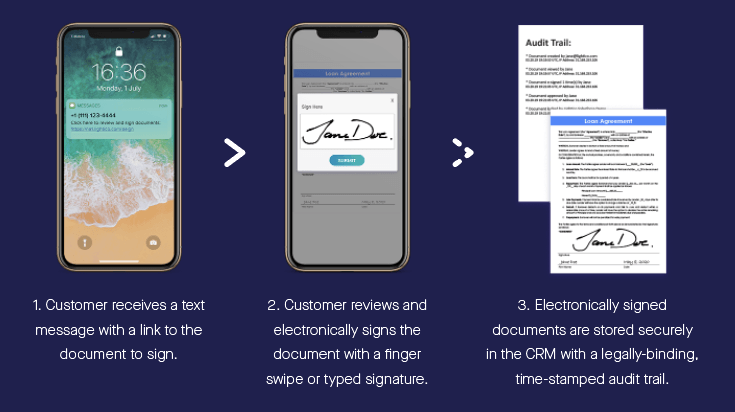

See All ProductsHow it Works

Lightico converts clunky PDF loan extension agreements and ACH forms into mobile-friendly forms, which can be filled and signed on the spot with finger swipes. The completed digitized documents are securely stored with the rest of the customer documents and records on Westlake’s CRM.

Service Approach

Technology & Service Combined

Lightico converts clunky PDF loan extension agreements and ACH forms into mobile-friendly forms, which can be filled and signed on the spot with finger swipes. The completed digitized documents are securely stored with the rest of the customer documents and records on Westlake’s CRM.

Business Impact

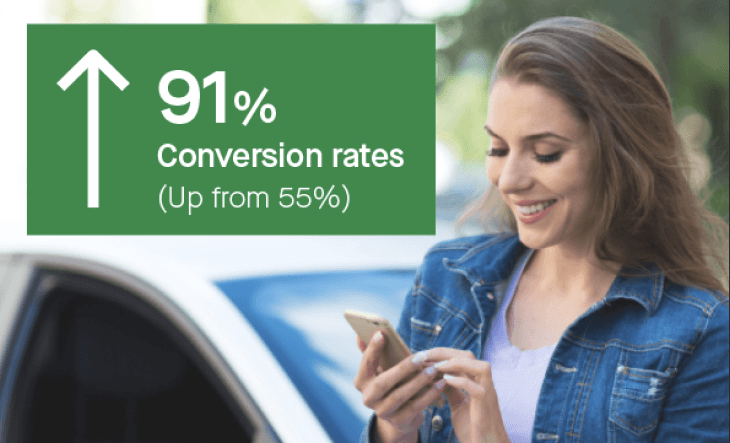

Thanks to the speed of Lightico’s real-time text messaging solution, over 90% of documents sent to customers via Lightico are completed by customers within 30 minutes of the initial request. No-code workflows are easy for admins to configure and update as needed, so customers always receive the right document request the first time.

As a result, servicing processes are more efficient, customers remain loyal, and Westlake Financial has strengthened its reputation as a forward-thinking, innovative auto lender.

The company is now looking into leveraging Lightico’s Digital Completion platform across other parts of its business.

Now More Than Ever, Support Your Customers Remotely

Instantly collect eSignatures, forms, documents & payments