What if your bank could reduce mortgage application time from 21 days to under 2 hours with zero disruption to core systems?

Key Takeaways

- Deploy compliant digital journeys in weeks using AI-powered no-code orchestration, instead of years with custom development

- Achieve 80% faster handling times and 5:1 ROI across mortgage, onboarding, and servicing processes

- Unify fragmented systems into one seamless experience layer without replacing legacy infrastructure

- Remove IT bottlenecks: business teams build and optimize regulated workflows independently

Executive Summary

Banks have invested billions in core system upgrades, workflow automation, and digital channels. Yet the customer journeys that matter most (mortgage applications, account opening, financial difficulty support, bereavement services) remain frustratingly slow and fragmented.

The reason? Most digitization efforts have focused on back-office efficiency. Customer-facing processes still suffer from manual handoffs, repeated data entry, channel switching and compliance-heavy paperwork that creates friction at every step.

Meanwhile, digital-native competitors like Rocket Mortgage, Chime and SoFi complete in minutes what traditional banks take weeks to process and according to McKinsey's Global Banking Review, customer expectations for frictionless digital experiences continue accelerating. Fintechs are not constrained by legacy systems or organizational silos and have built customer experiences around speed, simplicity, and mobile-first design. Traditional banks face a clear choice: digitize customer journeys rapidly and efficiently or watch market share erode to more agile alternatives.

Journey orchestration solves this challenge by working with - not against - your existing architecture. It provides an AI-powered orchestration layer that sits above existing banking systems, enabling institutions to digitize processes in weeks rather than years. When implemented effectively, journey orchestration delivers measurable cost reduction, faster revenue conversion, embedded compliance, and the seamless experiences customers now demand.

This guide explains what journey orchestration means for banking executives, why it has become an urgent priority for Chief Digital Officers, and how leading institutions are deploying it to gain competitive advantage.

A Clear Definition of Journey Orchestration in Banking

Journey orchestration is the coordinated design, automation, and real-time management of complete customer and agent workflows across regulated banking processes.

It aligns every step (what customers do, what banks must verify, and what regulators require) into one continuous, compliant digital flow. No channel switching. No repeated information. No manual handoffs.

Think of journey orchestration as the digital conductor that ensures every system, person, and process plays in harmony throughout complex banking interactions.

Importantly, journey orchestration does not replace established systems. Instead, it connects and augments them so customers experience one cohesive journey regardless of how many systems are involved behind the scenes.

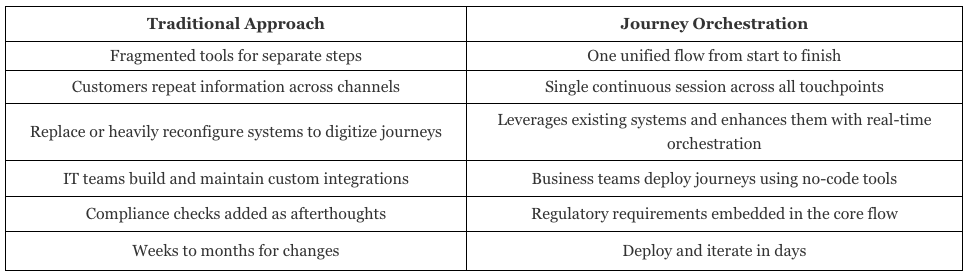

How Journey Orchestration Differs from Traditional Tools

Most banks already use workflow automation, loan origination systems (LOS), CRM platforms, and digital form builders. These tools handle individual steps efficiently. But they do not manage the complete customer journey.

Journey orchestration acts as a real-time digital layer above core banking, LOS, CRM, document management, and legacy systems. It connects what already exists without requiring system replacement, a critical advantage for heavily regulated institutions with complex infrastructure. This aligns with Gartner’s definition of hyperautomation, which highlights the need for orchestration across fragmented processes.

Why Journey Orchestration Has Become an Urgent Priority for Chief Digital Officers

Digital leaders face mounting pressure from three directions simultaneously:

- Customer expectations shaped by digital-first experiences: Consumers who complete mortgages, open investment accounts, or resolve service issues with fintech platforms in minutes will not tolerate week-long processes at traditional banks.

- Operational cost pressures demanding efficiency: Manual processing, document chasing, callbacks, and repeated verification create unsustainable cost structures as margins compress.

- Regulatory complexity requiring built-in compliance: Every customer interaction must meet KYC, identity verification, disclosure, consent, and audit trail requirements without adding friction.

Custom development cannot address these pressures quickly enough. Internal IT teams face 18 to 24 month backlogs. Building journey capabilities from scratch requires significant capital investment, extended timelines, and ongoing maintenance burden.

Stitching together RPA platforms, form builders, and workflow tools creates technical debt and fragmented experiences. These piecemeal solutions were not designed for front-end customer journeys or regulatory environments.

Journey orchestration platforms built specifically for regulated enterprises offer a different path: rapid deployment, minimal IT dependency, and immediate business value.

Six Executive Benefits Driving CDO Investment in Journey Orchestration

1. Deploy Compliant Journeys in Weeks, Not Transformation Cycles Measured in Years

AI-powered, no-code orchestration tools enable business teams to design, test, and launch regulated customer journeys rapidly. Product owners, CX leaders, and operations executives configure workflows directly without writing code or waiting for development sprints.

This eliminates multi-year dependencies on overextended IT teams and accelerates return on investment. Banks report launching new mortgage variants, account types, or servicing workflows in 2 to 4 weeks versus 6 to 12 months with custom development. This deployment speed matches fintech agility while maintaining regulatory rigor.

2. Achieve Large Reductions in Cost to Serve

Journey orchestration removes the manual work that inflates operational costs:

- Eliminate document chasing and repeated verification requests

- Reduce callbacks and channel switching

- Remove manual data entry and re-keying across systems

- Decrease processing errors and rework

Leading banks report 60 to 80% reductions in handling time across mortgage applications, account opening, and servicing interactions. This directly reduces operational expenditure while improving customer satisfaction and narrowing the efficiency gap with fintech competitors.

3. Accelerate Revenue Conversion Across Lending and Onboarding

Every day a mortgage application remains incomplete represents revenue at risk. Every abandoned account opening is lost relationship value.

Journey orchestration compresses timeframes from weeks to hours, matching fintech speed expectations:

- Mortgage applications completed in one session

- Account opening finished in minutes with instant identity verification

- Loan modifications processed same-day

Banks see completion rates increase 15 to 25 percentage points when friction disappears from acquisition journeys. This directly counters fintech advantage in conversion efficiency.

4. Embed Compliance Directly into Customer Workflows

Regulatory requirements, identity verification, KYC checks, required disclosures, consent capture, and audit trails are built into the orchestrated flow.

This reduces compliance risk while removing regulatory adherence as a source of customer friction. Every action is logged. Every disclosure is delivered at the required moment. Every consent is captured and stored appropriately.

Audit readiness becomes automatic.

5. Deliver Truly Unified Omnichannel Experiences

Customers begin journeys in mobile apps, continue with call center agents, complete steps in branches, and resume later online, all within the same continuous session.

Journey orchestration maintains context across every channel and touchpoint. Customers never restart. Agents always see complete history. The experience remains consistent.

6. Free IT Teams from Low-Value Configuration Work

Business users build, publish, and optimize compliant workflows independently. Technical teams focus on strategic initiatives instead of endless journey modifications and system integrations.

The no-code orchestration layer handles the complexity of connecting to core banking, LOS, CRM, payment systems, and legacy infrastructure through open APIs. IT maintains governance and security controls without becoming a bottleneck. Because the orchestration layer sits above existing systems, IT teams do not need to rebuild or re-architect legacy platforms. Instead, they focus on other strategic initiatives while orchestration handles day-to-day customer-facing workflow updates.

How Journey Orchestration Works Inside a Bank

Effective journey orchestration platforms designed for regulated enterprises share several core capabilities:

A Digital Orchestration Layer Above Existing Banking Systems

The orchestration layer integrates with core banking, LOS, CRM, payment systems, and legacy infrastructure, serving as a connective fabric that amplifies the value of these systems without requiring replacement.

Banks gain a modern experience layer without replacing infrastructure.

Single Continuous Sessions for Customers and Agents

Customers complete all required steps in one secure, guided flow:

- Upload and verify documents in real-time

- Answer questions once

- Receive instant feedback

- E-sign disclosures and agreements

- Complete identity verification

Agents working with customers access the same unified interface.

AI-Powered Intelligent Document Processing

Documents uploaded by customers are automatically:

- Classified

- Extracted

- Validated

- Cross-checked

This eliminates manual review bottlenecks, reduces processing time from days to minutes, and improves data accuracy.

In Practice: A mortgage applicant uploads six financial documents. The AI system identifies each document type, extracts income and asset data, validates figures, and confirms completeness within 30 seconds. The loan officer reviews only the pre-validated summary. Explore Lightico AI-IDP.

Embedded Regulatory Compliance and Audit Trails

Required compliance elements are built into journey design:

- Identity verification

- Mandatory disclosures

- Consent capture

- Data validation

- Complete audit trails

Consistent Across Assisted and Digital Channels

Whether customers interact with call center agents, branch staff, or self-service channels, the underlying journey remains identical.

Designed and Managed by Banking Business Teams

Product owners, customer experience leaders, operations executives, and servicing teams create and refine journeys using visual, no-code tools.

Why Augmenting Existing Systems Is the Most Practical Path Forward

Multi-year system replacement is rarely feasable for banks, nor can they pause operations for large-scale re-architecture. Journey orchestration succeeds because it works withwhats existing systems, turning them into real-time, customer-ready capabilities without modification. This approach allows banks to deliver modern digital experiences in weeks while preserving decades of investment in core platforms.

Where Journey Orchestration Delivers the Highest Impact in Banking

1. Mortgage and Home Equity Applications

Journey orchestration transforms documentation-heavy processes by enabling:

- Guided mobile sessions

- AI-powered document processing

- Real-time integrations

- Automated compliance checks

- E-signatures

Banks report completion times dropping from 21+ days to under 48 hours, with some refinances completed in a single session.

2. Account Opening and Onboarding

Journey orchestration streamlines onboarding by enabling:

- Instant identity verification

- Real-time validation

- Automatic funding setup

- Required disclosures with acknowledgment

Banks increase completion rates and reduce processing costs by 60 to 70%.

3. Financial Difficulty and Payment Relief

Journey orchestration enables:

- Secure self-service

- Guided document upload

- Automated assessment

- Instant presentation of relief options

- Full compliance documentation

One institution reduced processing time by 85% and increased satisfaction by 12 points.

4. Auto Finance Originations

Auto finance originations sit at the intersection of retail lending, dealer relationships, and regulatory scrutiny. These processes often involve complex documentation, multi-step validation, and rapid decisioning expectations from customers and dealership partners.

Traditional auto finance journeys include:

- Manual review of proof-of-income and employment documents

- Repeated data entry between dealer systems and the bank’s LOS

- Delays caused by incomplete or inconsistent documents

- High fallout when buyers cannot finalize financing in-session

- Compliance requirements related to fair lending, disclosures, identity verification, and adverse action notices

Journey orchestration transforms auto finance originations by enabling:

- Instant document upload and AI-powered validation at the dealership or remotely

- Seamless handoffs between dealers, customers, and underwriting teams

- Real-time integration with LOS systems and income verification services

- Embedded compliance controls, disclosures, and required consent capture

- One continuous digital flow that completes the entire origination journey in minutes

Leading lenders report:

- 50 to 70% faster funding times

5. Bereavement and Estate Management

Journey orchestration supports grieving families by enabling:

- Clear guided steps

- Secure digital document submission

- Automated verification

- Single point of contact

- Faster resolution

Institutions report 70 to 80% faster completion times.

6. Loan Servicing and Modifications

Journey orchestration enables:

- Self-service servicing

- Instant document validation

- Real-time system integrations

- Automated compliance checks

- Full transparency

The Measurable Impact: What Leading Banks Are Achieving

Efficiency and Cost Metrics

- 80% faster handling times

- 60 to 70% reduction in cost per transaction

- 50 to 80% fewer document-related callbacks

- 40 to 60% reduction in abandonment

Revenue and Growth

- 15 to 25 point increase in completion rates

- 5:1 ROI

- 2 to 3 day reduction in mortgage time-to-close

Regulatory and Risk

- 100% compliance

- Fewer regulatory findings

- Reduced operational risk

Customer and Employee Experience

- 10+ point NPS lift

- Higher employee satisfaction

- Improved first-contact resolution

- Stronger customer trust

Organizations Already Seeing Results

Trusted by HSBC, Santander, GM Financial, and other leading financial institutions, Lightico delivers:

- 5:1 ROI

- 10-point NPS lifts

- Up to 80% faster handling times

- Recognition from ECCCSA, Engage Awards, and Banking Tech Awards

Explore more examples in Lightico's Customer Case Studies

Understanding the Build vs. Buy Decision for Journey Orchestration

Even when systems are modern, they were never designed to work together as one unified customer-facing experience layer. Orchestration bridges this gap without requiring expensive redevelopment.

Why Custom Development Creates Risk and Delay

Many banks first consider building journey orchestration capabilities internally. In practice, this creates several predictable challenges:

- Extended timelines that compete with business urgency

- Significant ongoing maintenance burden

- Limited agility for journey changes

- High compliance and security risk

- High total cost of ownership

Why Piecemeal Solutions Create Fragmentation

Stitching together RPA, form builders, and workflow tools produces:

- Fragmented customer experiences

- Integration complexity

- Inconsistent compliance controls

- Higher operational costs

We explain this further in our guide Build or Buy

Common Questions Chief Digital Officers Ask About Journey Orchestration

How does journey orchestration differ from our existing workflow automation platform?

Workflow automation optimizes back-office processes. Journey orchestration manages customer and agent experiences across regulated front-end workflows.

Can we deploy journey orchestration without replacing core banking systems?

Yes. Journey orchestration platforms sit above existing infrastructure and integrate via APIs.

How quickly can we launch our first journey?

Most banks deploy their first journey in 4 to 8 weeks.

What happens to our IT roadmap?

Journey orchestration reduces IT bottlenecks and frees technical resources.

How do we ensure regulatory compliance?

Compliance controls are built into the platform, including disclosures, consent capture, identity verification, and full audit trails.

What’s the typical ROI timeline?

Most banks achieve positive ROI within 6 to 9 months. Leading institutions report 5:1 ROI within 12 to 18 months.

How does this work across multiple brands?

Enterprise orchestration platforms support multi-brand deployments with centralized governance and local customization.

Getting Started: A Practical Approach for CDOs

Start with High-Impact, High-Pain Journeys

Focus on journeys with the highest friction and regulatory complexity.

Establish Clear Success Metrics

Track improvements in handling time, conversion, cost per transaction, NPS, and compliance.

Involve Business Teams from Day One

Give product, CX, and operations teams ownership of journey configuration.

Plan for Iterative Improvement

Use rapid iteration to refine and enhance journeys continuously.

Build Internal Capability and Momentum

Early wins create organizational confidence and accelerate adoption.

The Competitive Reality - Why Timing Matters

Fintech lenders now originate a significant share of personal loans in the United States. Digital-native banks like Chime have acquired well over ten million customers in under a decade. Younger consumers increasingly prefer fintech platforms for primary banking relationships.

Traditional banks still hold significant advantages. But those advantages erode quickly when customer experience gaps remain wide.

The banks gaining ground are those closing the gap rapidly using orchestration platforms that deliver fintech-caliber experiences in weeks.

Every quarter you wait represents:

- Continued operational inefficiency

- Lost revenue from abandoned applications

- Ongoing disadvantage versus institutions offering seamless journeys

- IT bandwidth consumed by low-value journey modifications

- Growing market share loss to digital challengers

The question is no longer whether journey orchestration will become part of your digital architecture. The question is how quickly you can move to reclaim competitive parity before the experience gap becomes too wide to close.

Journey Orchestration as Strategic Imperative

Banks do not need to replace what they have already invested in; they simply need to orchestrate it. Journey orchestration platforms like Lightico turns existing systems into a modern, cohesive customer experience engine.

Journey orchestration gives banks a low-disruption path to digitize their most regulated customer processes. It unifies every step of the customer and agent experience into one secure, compliant, mobile-first flow while connecting to existing banking infrastructure.

For Chief Digital Officers, journey orchestration delivers what matters most: rapid deployment, measurable ROI within months, business agility independent of IT constraints, and fintech-caliber customer experiences.

Banks moving first are establishing compounding advantages. They are reducing costs, improving experiences, strengthening compliance, freeing IT capacity, and regaining competitive ground against fintech challengers.

If your bank is ready to digitize regulated customer journeys in weeks rather than years, the path is clear: identify your highest-impact journey, establish success metrics, and deploy an AI-powered orchestration platform built for regulated environments.

See Lightico Journey Orchestration Platform in Action

Book a customized demo and discover how leading banks are digitizing customer processes with zero disruption and immediate time-to-value.

Lightico is the only AI-powered journey orchestration platform built specifically for regulated enterprises. Trusted by HSBC, Santander, GM Financial, and other leading institutions, Lightico enables banks to design and deploy compliant digital journeys in weeks with minimal IT involvement and no system replacement.