360% ROI with Lightico

“We looked at all the solutions out there, and Lightico had a very comprehensive product with a cost-friendly pricing structure.”

Enhance Interactions With Your Bank's Customers

Watch The Video

New Customer Applications

Utilize workflows to provide an innovative experience

Change Accounts Details

Help customers help themselves with efficient self-service process to complete requests

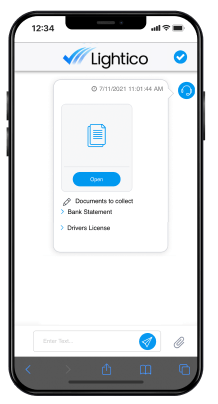

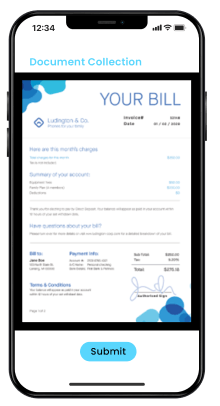

Collection of Documentation

Automate the document collection process with your CRM

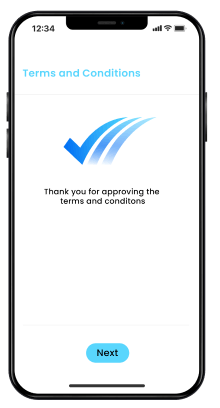

Fast, clear, and compliant

customer applications

100% compliance, 100% data integrity, 55% faster turnaround time. Automated workflows leverage capabilities like verifying ID, completing forms and signatures, collecting documents, instant consent on disclosures and T&C’s, to ensure customer processes are completed quickly and compliantly.

Eliminate call center burden and

simplify service requests

Slash call length by 35%, empower self-serve and boost NPS by 20 points. Deliver a seamless, completely digital, end-to-end experience for your customers.

Automated document collection

integrates with your CRM

Slash turnaround time by 40% with automated workflows. When your CRM identifies missing required documentation, it can communicate with the customer and collect the required documents autonomously through Lightico’s API.

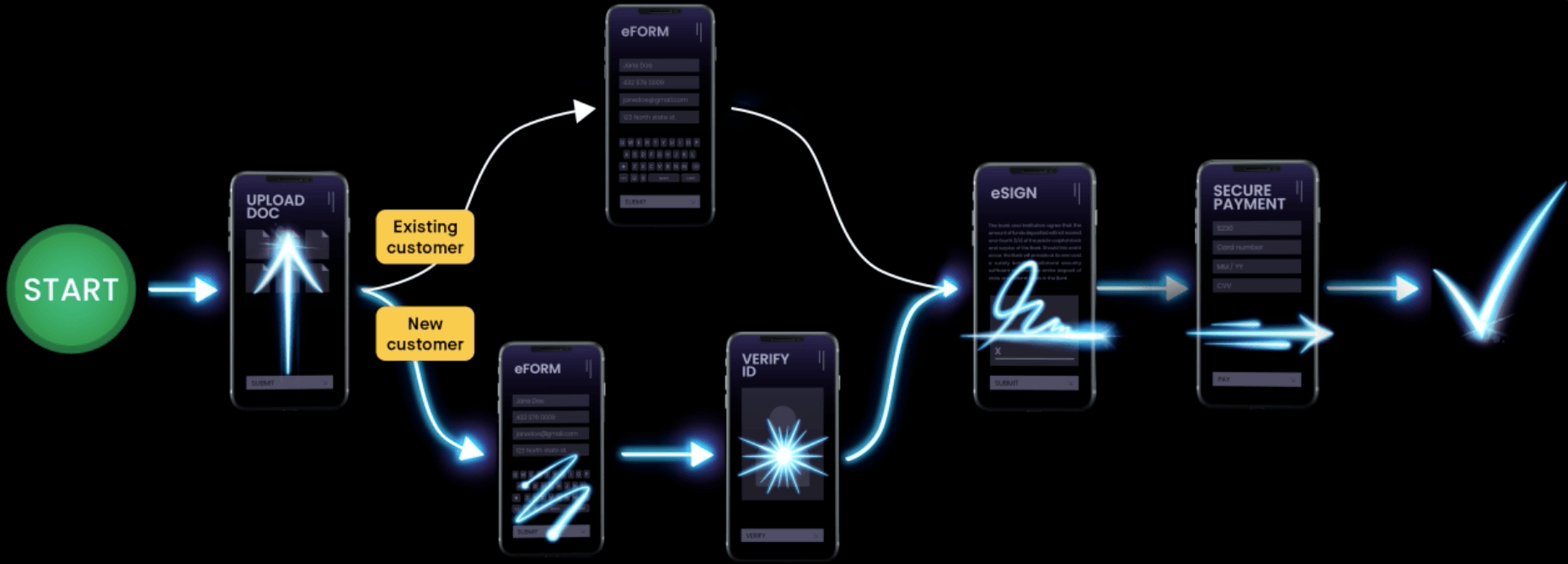

The Digital Completion Cloud

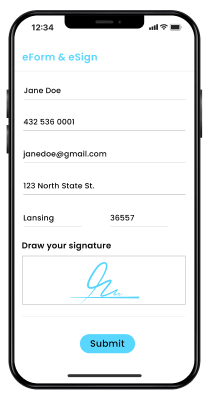

Digitally Complete Entire Customer Journeys

Put an end to long and painful customer journeys.

From eSigning forms, verifying ID, adding supporting docs, and more, customers breeze through the process, freeing up your agents to sell more and make your business more efficient.

Optimize lending, servicing and compliance with automated workflows

Easily create no-code workflows to fine-tune every step of the customer journey for maximum completion.

INTEGRATE SEAMLESSLY

Blend Lightico into your Business Environment

Let customers complete directly from your LOS, CRM, mobile app, website, IVR, or call center system. And with real-time sync, your back-end stays perfectly updated, eliminating rework.

Start Completing at the Speed of Lightico

Instant eSignatures, IDV, Document Collection & More