Instant KYC

Keep fraudsters out — without inconveniencing customers. Easy ID verification, anywhere.

How Digital ID Verification Works

Born For Mobile Completion

Stay secure without compromising on your customer experience.

Start Completing

At the Speed of Lightico

“A user-friendly way to handle the heavy lifting of getting your contracts sorted!”

The Digital Completion Cloud

Digitally Complete Entire Customer Journeys

Put an end to long and painful customer journeys.

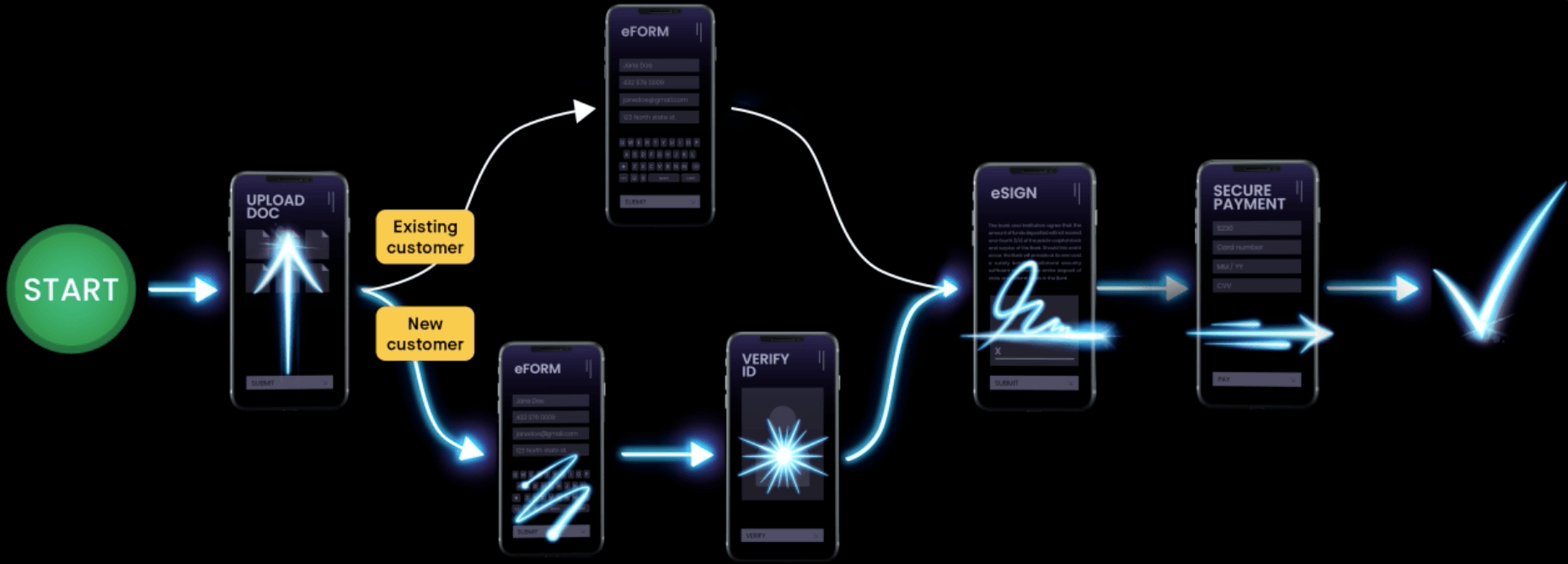

From eSigning forms, verifying ID, adding supporting docs, and more, customers breeze through the process, freeing up your agents to sell more and make your business more efficient.

Build ID Verification into

Your Completion

Workflow

Combine digital ID verification with other completion apps to create the perfect workflow for any business logic. Automated processes, completely code-free.

Fast ID Verification. More Completion.

Instant

Lightico offers real-time ID verification directly from your customer’s cell phone. This reduces the need for in-person visits and eliminates the need to chase down customers for documents via email and fax.

Frictionless

Smooth and intuitive ID verification and authentication ensure maximum fraud protection and security while maintaining efficiency and customer experience.

Agent Guided

Call agents can easily guide customers through the ID verification process while on the phone to ensure processes are completed instantly.

More ID Verification Resources

3 Elements of a Customer Identification Program for AML Compliance

A customer identification program (CIP) involves verifying information provided by a customer. Businesses do this…

Read MoreCar Loan Fraud is Rampant: Here’s the Simple Secret to Crush it Today

Car loan fraud is running rampant in the auto finance industry. Far from a victimless…

Read MoreDigital Workflows for Automating Insurance Sales: Use Cases

P&C insurance companies rely on new policy sales to ensure continuous growth. Yet traditional customer-facing…

Read More"Great tool to expedite customer service"

The most helpful thing about Lightico is the fast turnaround time, The upside is that you are giving your customer an easy way to respond quickly and efficiently. Lightico has cutwork and waiting time as you can send customer forms via text and get them back quickly, very convenient for both parties."Great Service and Product"

I love the fact that I can send or request documents from a customer and it is easy to get the documents back in a secured site via text message. Our company switched from Docusign to Lightico, as Lightico is easier and more convenient than Docusign, as the customer can choose between receiving a text message or an email.Start Completing at the Speed of Lightico

Instant eSignatures, Payments, Document Collection & More

Lightico Photo ID Verification FAQ

ID verification refers to the ability to prove a person’s claim to a certain identity is legitimate. There are many technological services and capabilities that enable ID to be verified practically beyond a shadow of a doubt. Such services are critical in an era when identity theft schemes are more sophisticated than ever.

Furthermore, companies, particularly financial institutions, are concerned with complying with Anti-Money Laundering and (AML) and Know Your Customer (KYC) regulations. ID verification is a critical aspect of satisfying these measures.

ID verification works differently depending on the particular method or software that’s being used. Lightico’s ID verification capability is able to confirm an individual’s identity through an entirely digital process. Here’s how it works:

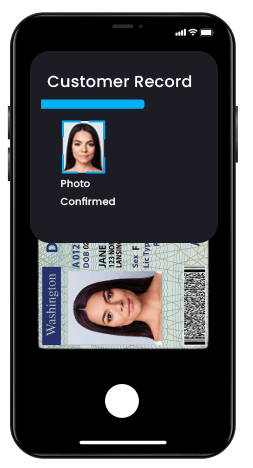

Government Issued ID can be verified straight from a customer’s cellphone, wherever they are. The customer simply takes a photo of their ID and a live selfie using their cell phone camera, they are matched and verified in seconds using the latest AI technology. This convenience is not only efficient for the business but also very convenient for customers.

- A company representative sends the customer a text message with a link that opens to a secure mobile session.

- The customer snaps a picture of their ID and a live selfie with their mobile phone camera.

- The selfie is matched with the ID, and verified using AI technology.

- The customer can also upload documents, fill out forms, and provide an eSignature — all in the same session.

With more business than ever moving online, it’s critical to establish the legitimacy of online customers. Electronic ID verification uses a combination of personally and publicly available data to establish a person’s identity. Computerized systems are able to compare these pieces of information and determine if there’s a full match, a partial match, or no match.

ID verification enables businesses, particularly financial institutions, to prevent fraud, maintain compliance, and foster public trust in their company. In addition, governmental bodies such as the IRS frequently require ID verification, which checks the veracity of personal account numbers from credit cards, mortgages, student loans, home equity loans, and car loans.

In the case of the IRS and many other bodies, the ID verification process involves agents asking a series of questions that only the respondent knows the answer to. This significantly reduces the probability of fraud, but it’s also more time-consuming than some of the latest AI-based digital verification technologies. Companies that move to electronic ID verification will see their security improved without any negative impact on their efficiency.

Know Your Customer (KYC) verification refers to the process of identifying prospective customers to make sure they truly are who they claim to be. The term also refers to the anti-money laundering and compliance regulations that drive financial institutions’ determination of who is allowed to conduct banking, and who isn’t.

Yes. Banks are bound by regulations that require them to conduct KYC procedures. Whether it’s through face verification, ID card verification, or document verification, financial institutions need to have some way of verifying an applicant’s identity. The rules are stringent because the stakes are high: identity theft, money laundering, terrorist activity, and other schemes are all possible without KYC verification in place.

Anti-money laundering (AML) refers to rules, procedures, and regulations designed to prevent bad actors from concealing illegally obtained money or passing it off as legitimately earned. Not all banking transactions are regulated by AML laws, but some such as new customer onboarding are. Furthermore, banks continuously monitor their customers’ banking activity and are required to report suspicious behavior.

The terms KYC and AML are very similar, but not exactly the same. KYC refers to the process of banks verifying customers’ identities before permitting transactions. AML is a broader term that covers all measures financial institutions take to fight terrorist financing, money laundering, and other criminal actions.

KYC is a crucial component of any financial institution’s broader AML efforts. Any financial institution that onboards new customers will need to ensure KYC procedures are in place. While AML requires more than just KYC, KYC is an essential part of it for banks.

Just as KYC is a component of AML, Customer Due Diligence (CDD) is a component of KYC. It is a way of collecting customer data surrounding name, place of residence, and other identifying details — and then assessing the level of risk the customer presents.

Enhanced Due Diligence (EDD) is yet another aspect of the KYC process that’s reserved for customers deemed high risk. Whether it’s due to the location of their business, nature of their business, business or personal relationships held by the customer, or something else, some customers possess certain characteristics that make them more likely to be bad actors. Rather than just turn away everyone who presents as high risk (and lose out on legitimate business opportunities) banks employ EDD to keep a closer eye on these customers.

Know Your Customer (KYC) refers to the process by which banks ensure prospective customers are legitimate both before opening an account, and while conducting transactions while maintaining an account.

KYC is critical to the banking industry because it ensures that criminals and other bad actors can’t easily disguise or hide illegitimate funds. KYC processes protect banks from financial and reputational harm, and help ensure compliance with government regulations.

eKYC stands for Electronic Know Your Customer. It refers to digitized ways of verifying customer identities and preventing fraud. The major advantage of eKYC is that it’s far less time-consuming and cumbersome than traditional KYC, while maintaining or increasing adherence to regulations and rules.

Lightico makes fulfilling KYC compliance requirements simple for both banks and their customers through digitization. Customers simply send a government-issued ID to their bank, along with a live selfie with their mobile phone camera. Lightico uses forensic-level forgery and spoofing auto detection to determine whether there is a match. Lightico’s technology exceeds the regulatory requirements, making it a good choice for both security-minded and convenience-minded banks.

AML stands for Anti-Money Laundering. It refers to a broad set of measures banks take to reduce their exposure to bad actors using their banks to disguise illegitimate funds as legitimate income.

The AML process is critical for banks’ financial and reputational standing. First and foremost, there is no getting around AML — auditors and regulators require it, and banks’ compliance officers will in turn demand it. Due to new and more stringent regulations over the years, many banks are turning to digital, AI-based solutions to tackle compliance with greater efficiency.

Lightico’s digital ID verification capability allows banks to significantly reduce ID-related fraud through an AI-based system that compares customers’ selfies with uploaded IDs. It also reduces the cost of staying compliant and increases agent efficiency. It takes less than 10 seconds to authenticate ID using Lightico, which is more than 20 times faster than other products on the market.