First Bank Completes Banking Journeys 98% Faster With Digital Completion

Banking Turnaround Times Go from Days to Minutes With Real-time E-Signatures & Doc Collection

Background

Leading Community Bank Aims to Speed Up Loan & Account Servicing

For First Bank, a leading community bank serving customers in Southeast Illinois and Southwest Indiana since 1893, making it easy for customers to reach their financial goals is paramount. Chris Bailey, First Bank’s SVP & Chief Technology Officer, was seeking to digitize banking services for its customers such as loan servicing, automatic fund transfers, overdraft services and debit card applications — and in parallel eliminate the burden of paper-heavy administrative processes for employees.

We chose Lightico over DocuSign because of better technology and mobile experience and without reliance on an app. Client satisfaction has gone up while we’re also saving time internally. Lightico is easily one of the best vendors I deal with.

Challenge

Cumbersome Legacy Email Hurting Loan Servicing

First Bank’s key objective is offering their customers the convenience of taking out loans and opening accounts from wherever they are. But many loan agreements and modifications relied on legacy processes which required their customers to download and print lengthy PDF-based forms from their inbox, sign them, and scan or fax these paper documents just to send them back. Limited e-signature tools did not help customers complete these processes as they required customers to visit their app store and download an esign app essentially for a one-time event — This delayed completion of these processes and negatively impacted turnaround times.

“Getting customers to start the process was slow and frustrating. Our loan officers and loan assistants were spending extra time chasing clients down just to get things signed, which impacted sales goals — If they’re spending time chasing down documents, then they are not meeting with other clients or prospects.”

To accelerate banking processes and improve business results, the First Bank team searched for an innovative solution that let customers easily sign forms and documents from their smartphone in real-time, without having to bounce between multiple channels or download additional apps.

Solution

Completing Banking Journeys in One Real-time Digital Session

Chris first experienced Lightico’s Digital Completion solution at an industry conference, and saw first-hand how a banking customer could simply receive a text message and tap on the link to complete a banking process live, instantly, and securely.

In one intuitive digital session designed specifically for mobile, the customer can complete and digitally sign any required forms without having to download lengthy PDF forms from their inbox or install an app. Any needed supporting docs can be uploaded directly from their smartphone, and verifying ID or providing photo identification are as simple as taking a selfie and picture of the ID and uploading them to the session.

Business Impact

Turnaround Times Drop Dramatically

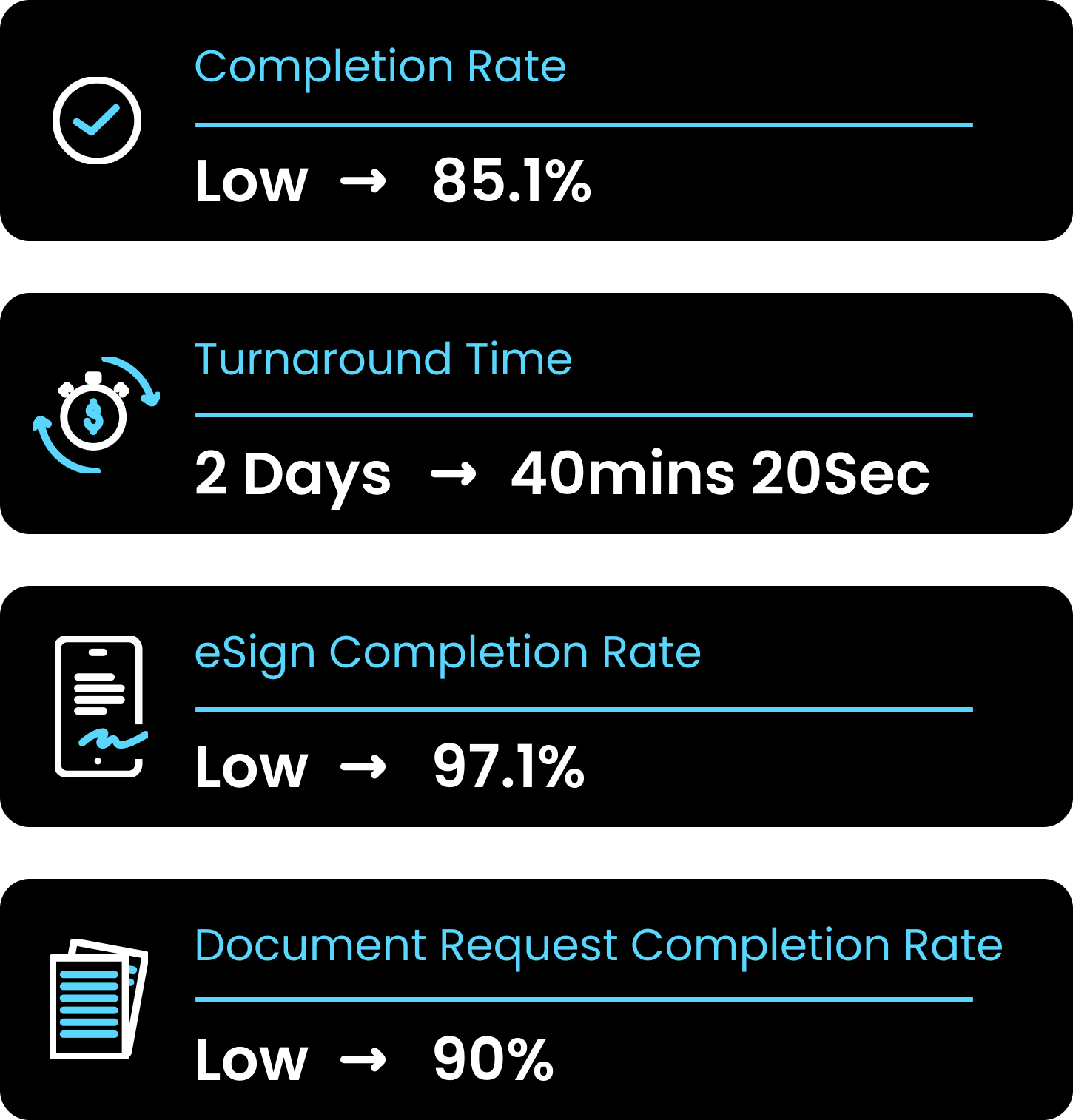

The First Bank team set an initial goal to reduce Turnaround Time to two days or less — but after implementing Lightico’s Digital Completion Cloud to accelerate their customer-facing processes — average turnaround times lowered to just over 40 minutes.

We saw the turnaround time of account documents reduced pretty significantly, while time handling loan exceptions dipped right away. Our clients love it — The experience on smartphone is the key and they need to make fewer trips to the branch.

With customers able to digitally complete the journey from their mobile phone, First Bank saw completion rates for all retail banking transactions jump to 85%. Specifically for e-signatures, these completion rates have improved to over 97%, and to 90% for collecting requested documents.

But it’s not just customer satisfaction that has lifted up due to replacing siloed solutions and legacy processes with end-to-end digital banking. Going paperless is cutting down on administrative tasks, and freeing up employees to focus on activities that make an impact.

“Lightico has sped the client experience up and this has saved a lot of time for our staff and internal workflows… and the Single Sign-on (SSO) we just completed has made it even easier for them to use.”

Looking Ahead

Driving ROI Across the Organization with Digitization

After seeing how much faster they’ve been able to complete loan agreements for their clients, Chris and the First Bank team are looking to improve return on more banking processes though digitally complete banking journeys.

“We’re looking to expand the use of Lightico to more of our banking processes given the remarkable time savings and ROI we’re gaining by digitizing the experience for our customers.”