Global Lending Services Selects Lightico to Digitize Loan Originations Process

Auto lender slashes funding turnaround time and increases completion rates with Lightico

Background

Leading Indirect Auto Lender Seeks Process Automation

Global Lending Services (GLS) is a South Carolina-based automotive subprime lending company that purchases thousands of auto finance contracts every month from franchise auto dealerships throughout the United States.

GLS is focused on providing dealers and their customers with the highest level of service and value. Although the company is renowned for leveraging state of the art data and technology solutions to serve their dealers, some of their existing processes for collecting customer information were causing longer funding turnaround times.

GLS required a solution to automate and accelerate the collection of customer stipulations and required documents in order to achieve best-in-class service levels.

The Challenge

Manual, Ineffective Stipulation and Document Collection

GLS’ decisioning process required agents to manually chase customers for missing stips and documents in order to able to fund the loan.

Agents would have to call each applicant who hadn’t provided all the required stips and request documents such as drivers license, proof of residency, proof of income and references to ask them to scan them and send via email.

That process was cumbersome for customers and staff, who often had to chase customers multiple times to obtain the required stips for the loan to be funded. This inefficient method of document collection resulted in low completion rates, lengthy funding turnaround times and impacted staff productivity negatively.

These challenges inflated costs and slowed efficiency.

To remain competitive, a digital solution was required to automate the process and enable missing documents to be collected quickly and easily at the convenience of both the customer and staff.

“Our business success is reliant on the speed and quality of service that we provide to dealers and their customers. Since implementing Lightico’s solution, we’ve been able to accelerate funding turnaround time thanks to automated workflows. This has enabled us to speed up the customer verification process and provide service excellence to thousands of customers across the USA.”

Solution

Automated, Digital Loan Originations

GLS implemented Lightico’s solution to automate the collection of missing stipulations and provide customers with a seamless customer experience.

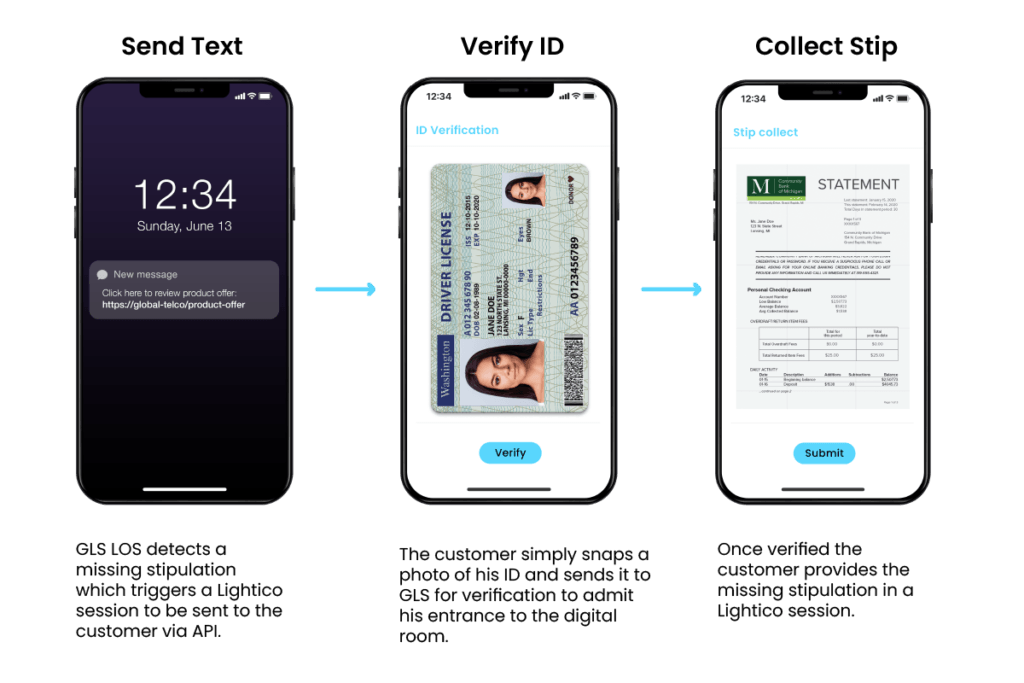

Lightico was integrated with the company’s existing loan origination system (LOS) in a short period of time. When a missing stipulation is detected via the LOS, Lightico’s API triggers a text message to be sent to the customer to notify them of the missing drivers license, utility bill or other document.

With a quick snap of their phone camera, the customer captures the missing stipulation and sends it back to GLS in seconds.

Customers that don’t complete the collection through the automated system are routed to staff for agent-assisted follow-up and gathering of documents.

Agent-assisted follow-up was still far faster than before since customers, while on the phone with an agent, could quickly send the missing stipulations without being bounced to another channel such as email.

Since adopting Lightico’s digital platform, the whole process is automated and agents spend less of their valuable time calling customers to request missing documents and stips.

As a result, loans are funded faster and agents invest their new found time in servicing customers and providing a better customer experience – solidifying GLS’ reputation as a leader in the auto finance industry.

How it Works

When the LOS detects missing stip, a text message to customer is triggered via API requesting the missing document to be sent back via the customer’s cell phone.

Business Impact

Faster Turnaround Time and Completion Rates

Thanks to the speed and intuitivity of Lightico’s solution, turnaround time for collecting stips was halved and completion rates increased by 43%.

As a result, time to funding has drastically improved, productivity has increased and GLS has strengthened its reputation for providing the highest level of service and value to dealers and their customers.

The company is now looking into expanding Lightico’s digital capabilities to further use cases.

“We selected Lightico to automate our originations process because of the solution’s ability to seamlessly integrate with our existing business systems, their unparalleled mobile optimized technology, intuitive interface, high security standards and their strong focus on service. We’re excited about the success of our partnership with Lightico and the opportunities it will continue to provide for our business. “