Happy State Bank Selects Lightico as their Digitization Partner to Boost ROI & Customer Satisfaction

Regional Bank Slashes eSignature Turnaround Time from Weeks to Minutes with Lightico

Background

Hospitality Seeks Innovation

Happy State Bank is a leading Texas-based regional bank famous for its strong family values and forward-thinking approach. The bank’s Vice President Stacie Smith and Business Systems Director Mark Murray were looking to harness innovative digital tools to improve in-branch processes and deliver hard ROI, while retaining their friendly, hospitable service.

We looked at every player in the market to digitize our processes — none of them really had that exceptional service feel and ease of use that could apply to all of our customers. We chose Lightico because of the ease of use and text message approach. It’s a familiar but powerful interface.

Challenge

Collecting Signatures on Account Documents in a Timely Manner

If all parties on an account were not in-person when opening an account, Happy State Bank relied on pen and paper processes to collect signatures on new account openings and account revisions. Many documents required multiple signatures, and customers who came into the branch to establish accounts would often have to take the documents home to collect the remaining signatures and then return either by mail, or to the branch to physically drop off the completed documents.

That process was inconvenient for customers and frontline branch staff resulting in lengthy turnaround times, and a cumbersome experience — hurting Happy State Bank’s customer-centric reputation.

To remain competitive and provide the best customer service, Happy State Bank needed a solution to further digitize its customer-facing processes and make banking convenient and intuitive for all of its customers.

When customers come into the bank to establish new accounts, multiple signatures are often required. Before using Lightico, we would have to mail them out to other signers to complete. That antiquated process was very time consuming and customers often didn’t complete the process.

Solution

A Fully Digital, Streamlined Customer Journey

Happy State Bank implemented Lightico’s Digital Completion platform to digitize and streamline banking processes for both their commercial and consumer customers. Once the no-code workflow was implemented, branch staff could initiate a session on their desktop which sends the customer a text message containing requests for form completion, signatures, and photo ID. Signers receive the text message and enter the link where they can quickly and easily fill out forms, provide eSignatures, and submit documents via an intuitive interface, without the need to show up to a physical location.

Results

Dramatically Reduced Turnaround Time

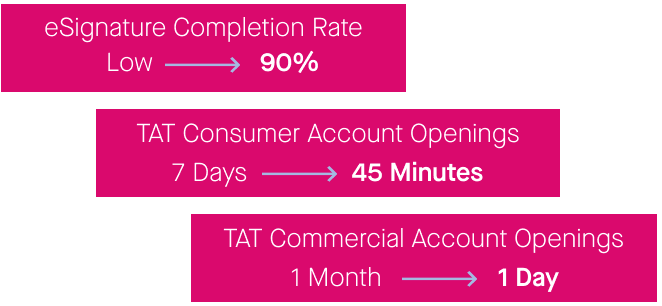

Happy State Bank now provides thousands of Texas businesses and consumers with an instant, effortless banking experience, whether they come to the branch or are on the go. Thanks to seamless workflows, signature completion rates are now at 90%, most of which are completed via the customer’s cell phones. The average turnaround time for documents on consumer account openings requiring multiple signatures has decreased to 45 minutes from an average of 7 days and for commercial account openings requiring multiple signatures, turnaround times have decreased to two days from an average of a month.

As a result of the Lightico Completion platform, customers are happier, internal processes are more efficient, and Happy State Bank has strengthened its reputation as a forward-thinking, customer-centric bank.