« Quick Summary » This blog post will take a closer look at 3 goals insurers must meet right now in claims processing to take advantage of the new industry landscape and customer expectations:

- Quickly complete all required documents.

- Full regulatory compliance.

- Payout the claim as fast as you can.

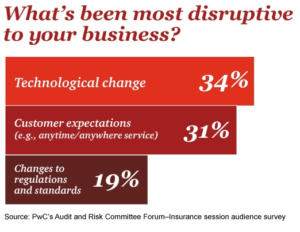

In the vast majority of cases, the delays in processing these claims has more to do with inefficient workflows than with an active effort to dodge claims payments. But for customers waiting on important claims, the end result is the same: They quickly grow frustrated by a poor customer experience. In reality, insurance businesses have every incentive to keep their customers happy. A recent report from McKinsey & Company found that satisfied customers are 80 percent more likely to renew insurance policies than if they’re unhappy with their customer experience. And efficient insurance workflows are playing a greater role than ever in delivering this experience: The same report found that agile, cross-functional claims processing platforms were able to increase customer satisfaction for insurance companies by 50 percent. Meanwhile, a report from Deloitte addressing life insurance underwriting found that when the application processing approaches real-time speeds, the prospects of the applicant purchasing a policy rise from about 70 percent to nearly 90 percent. No matter how streamlined your claims processing workflow might be, there are certain boxes that need to be checked in order to ensure that customers are happy and business goals are met. Here are three such considerations that should be made a top priority. A recent survey by PwC found that nearly 65% of industry disruption was due to technology and customer expectations to be anywhere any time.

(Photo: PWC)

(Photo: PWC)

Insurance claim Processing Goals

How can Insurers attack these disruptions head-on and meet their customer expectations. Here are 3 goals insurers must meet right now in claims processing to take advantage of the new industry landscape of 2018, 2019, and beyond.1. Completion of All Documents and Agreements

No matter how quickly you promise to process insurance claims, no claim can move forward without essential information. This includes all completed documentation, which can vary widely depending on the type of claim being processed. With an auto claim, necessary documentation could include a policyholder’s claim form, as well as a registration certificate, photocopy of a driver’s license, an adjuster’s proof of loss report, repair estimates and/or an invoice for those repairs. Medical claims, by contrast, require completely different documentation that includes an itemized bill, a summary of action, pre-authorization forms with all the necessary signings, and additional documentation if government healthcare assistance is required. Insurers often depend on outside parties to submit these documents correctly, but insurance companies can support faster, more efficient delivery by offering digital channels to submit documents, rather than operating via fax or snail mail. As Forbes points out, insurers can facilitate improved completion by addressing the mobile customer through his smart phone to gather documents and supplemental information, thereby accelerating claims processing.2. Regulatory Compliance

Speed can’t be pursued at the expense of industry compliance. Insurance companies must accommodate a number of regulations designed to protect consumers while guaranteeing them a minimum standard of service. In addition to a set of regulations enacted by the National Association of Insurance Commissioners, each state has its own laws in place that govern insurance practices, including claims processing. According to Insurance Journal, regulators and consumers are increasingly concerned with the methods insurance companies use to gather information when deciding on coverage and/or processing claims. A worthwhile solution to this problem is to implement processing software that makes sure these guidelines are being met. Rapid advances in technology are causing these regulations to evolve quickly, and insurers must stay on top of new, complex regulations. The challenge is that many of these regulations create extra work that can slow down an organization’s ability to process claims quickly. To overcome this challenge, a streamlined workflow is necessary, and insurance processing software with built-in regulatory compliance features is one way to accelerate claims processing as quick as possible, without breaking the rules and suffering a setback as an organization.3. Timely Reimbursement and Settlements

We’ve already noted the importance of timely resolution of claims as it pertains to customer satisfaction, but it’s worth emphasizing the role timely resolution plays in shoring up a company’s return-on-investment. If longer processing times put continued business from customers at risk, fast processing serves an insurer’s bottom-line. According to the International Journal of Lean Six Sigma, there are at least eight aspects of processing that can affect the overall time required to resolve a claim. Addressing all of these variables requires a multi-pronged effort. It’s not as simple as telling workers to speed up processing. To make sure claims are processed correctly, staff must be adequately trained on the software and solutions being used to expedite claims processing, and speedy resolution must be prioritized as an individual and team goal. With the right tools in place, it’s easier to drive a culture change that puts the customer experience center-stage. Meanwhile, faster processing allows employees to be more efficient, managing a higher volume of claims at any one time. This enables workers to provide more attentive service to those in-progress claims instead of juggling a larger volume of claims, all of them stuck in varying stages of completion. When all of the steps in processing a claim are executed correctly, customers can receive excellent, fast service and quick claim resolution. Insurance companies should turn their focus to adopting the resources and mindset needed to help their staff succeed at meeting these business goals. Insurance companies that are already using Lightico are meeting and exceeding these goal. They are making their clients happier and spending less time chasing paper. Lightico speeds on-boarding, automates claim procedures & simplifies renewals. Lightico’s insurance solution make policy renewals and claims processing a breeze for both agent and client. Download the insurance solution brochure. Speak with a solutions expert and crush your goals and KPIs.