Streamlining First Direct’s Mortgage Journey

Company

First direct, a subsidiary of HSBC, was established in 1989 as a bank that exclusively operates through telephone and online channels. It serves more than 1.7 million customers, offering a comprehensive range of personal banking solutions including current accounts, loans, credit cards, savings and mortgages.

first direct are the pioneers of easy banking. The people-powered bank. The bank that does things differently. From day one first direct disrupted what banking looked like, bringing customers a revolutionary branchless bank experience with real people answering the phone 24 hours a day, 7 days a week – even Christmas Day and New Year’s Day!

first direct is dedicated to assisting customers with their financial needs and strives to provide them with valuable products and services, empowering a new generation to realize their potential.

"Implementing the platform has significantly improved our mortgage journey. The streamlined process and integration into our internal systems has had a fantastic impact on customer and agent experience, and has improved our operational efficiency. The unified case ID and integrated e-signature feature has saved time in the end to end journey, and reduced reliance on manual processes making us more efficient. The platform has helped first direct demonstrate our commitment to innovation and customer-centricity.”

Challenge

As part of their vision to provide a more streamlined, digital first mortgage journey, first direct conducted a thorough examination of their telephony mortgage application processes. Several significant pain points were identified including inflating costs and lengthening journeys causing customer frustration.

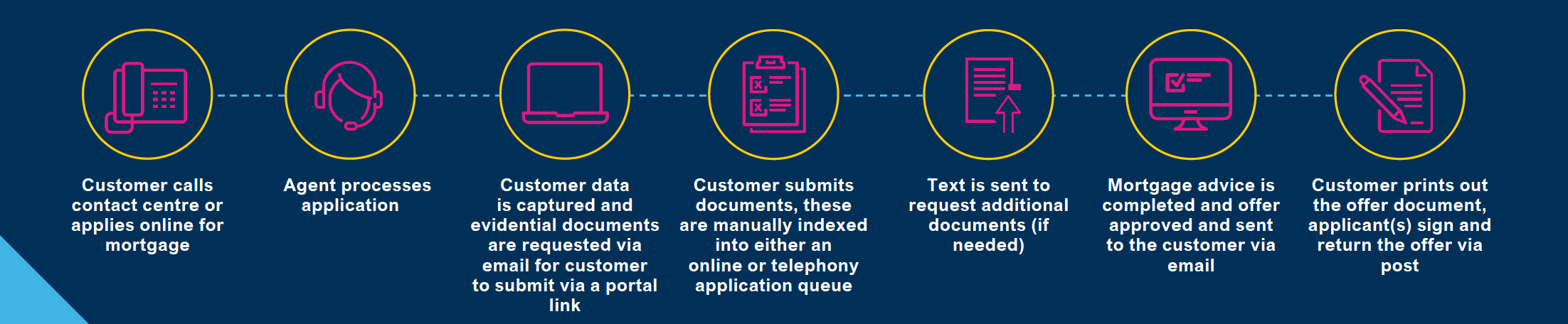

The mortgage process begins with a telephone call to the mortgage team. No information was supplied by the customer in advance of the call, so agents would ask the customer about their needs, as well as check relevant circumstantial factors such as income and affordability.

After the call concluded, the agent would send an email pack containing relevant information and documents to the customer, who would then be expected to submit the required documents via a separate portal which then required manual indexing of the documents onto the customer folder.

In the first direct mortgage journey, internal process requires the bank to progress customers through eight separate stages:

Solution

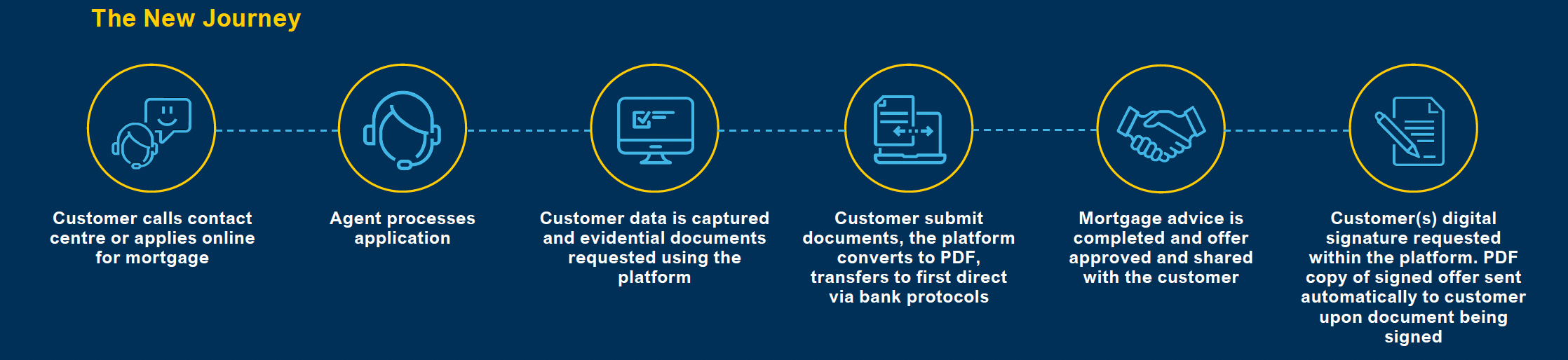

first direct utilised the platform to enhance the customer journey. Using our cutting-edge solution first direct were able to streamline the mortgage advice process by collecting customer information prior to the advisory session.

The solution also ensures a seamless experience by incorporating double verification through email and SMS, employing a one-time password (OTP) system. This extra layer of security safeguards customer data and prevents unauthorised access.

One of the key features of our platform is its ability to enhance personalisation. Instead of creating new emails or cases for each interaction, the solution utilises a unified case ID. This means that customers, including multiple applicants, can conveniently provide additional documents or attachments within the same case, making the process more efficient and hassle-free. Gone are the days of repeatedly requesting documents or navigating through multiple email threads.

Furthermore, the new journey eliminates the need for customers to sign documents on separate platforms. By integrating the e-signature capabilities of Adobe Sign into the same platform, we ensure a seamless and cohesive experience for its customers. This integrated approach saves customers time and eliminates the frustration of having to switch between different platforms to complete the signing process. It is also a sustainable solution as removes the requirement for signed offers to be returned from the customer via post.

The partnership signifies a commitment to delivering a customer-centric approach to mortgage services. By leveraging the capabilities of our platform, customers can expect a more personalised, efficient, and user-friendly experience throughout the mortgage advice journey. With this solution, first direct aims to simplify the process, making it easier and more convenient for customers to navigate the necessary documentation and signatures required for their mortgage application.

Streamline and Automate Customer Processes

Instantly collect eSignatures, forms, documents & payments