Gravity Lending Partners with Lightico To Launch Fully Digital Loan Originations

Innovative lender achieves 400% growth and exceptional customer experience with Lightico.

Background

Cutting-Edge Lender Seeks Digitization Partner

Gravity Lending is a Texas-based fintech company offering a vast array of consumer lending products including auto loans, home improvements, personal loans and improvements and personal loans.

The company is focused on connecting customers to the lowest-cost loans for all their lending needs and giving them quick access to the funds they require. Time to funding and a smooth customer experience is key to their business success.

When Gravity Lending was founded in 2019, they required a solution that could enable them to provide a completely streamlined digital originations process, fast time to funding and an exceptional customer experience.

We selected Lightico because the technology is secure, intuitive and provides the customer with a superior experience compared to other eSignature providers. The results show that we made the right choice in vendor and I would recommend Lightico to other lenders and banks seeking an eSignature solution.

Challenge

New Lender Seeking eSignature & Stip Collection Solution

As a new provider in the lending market, Gravity Lending had to be faster, better, more efficient and provide a better customer experience over existing, known lenders in the market in order to succeed.

The founder wanted to make Gravity Lending as close to 100% digital as possible in order to maximize operational efficiency, ensure compliance and security, avoid errors, provide the best customer experience.

They were looking for a solution that could enable seamless digital eSignatures, stip collection and payments.

Solution

Mobile eSignatures & Intuitive Stip Collection

Gravity Lending selected Lightico’s solution to collect all signatures and stips digitally while providing customers with an exceptional customer experience.

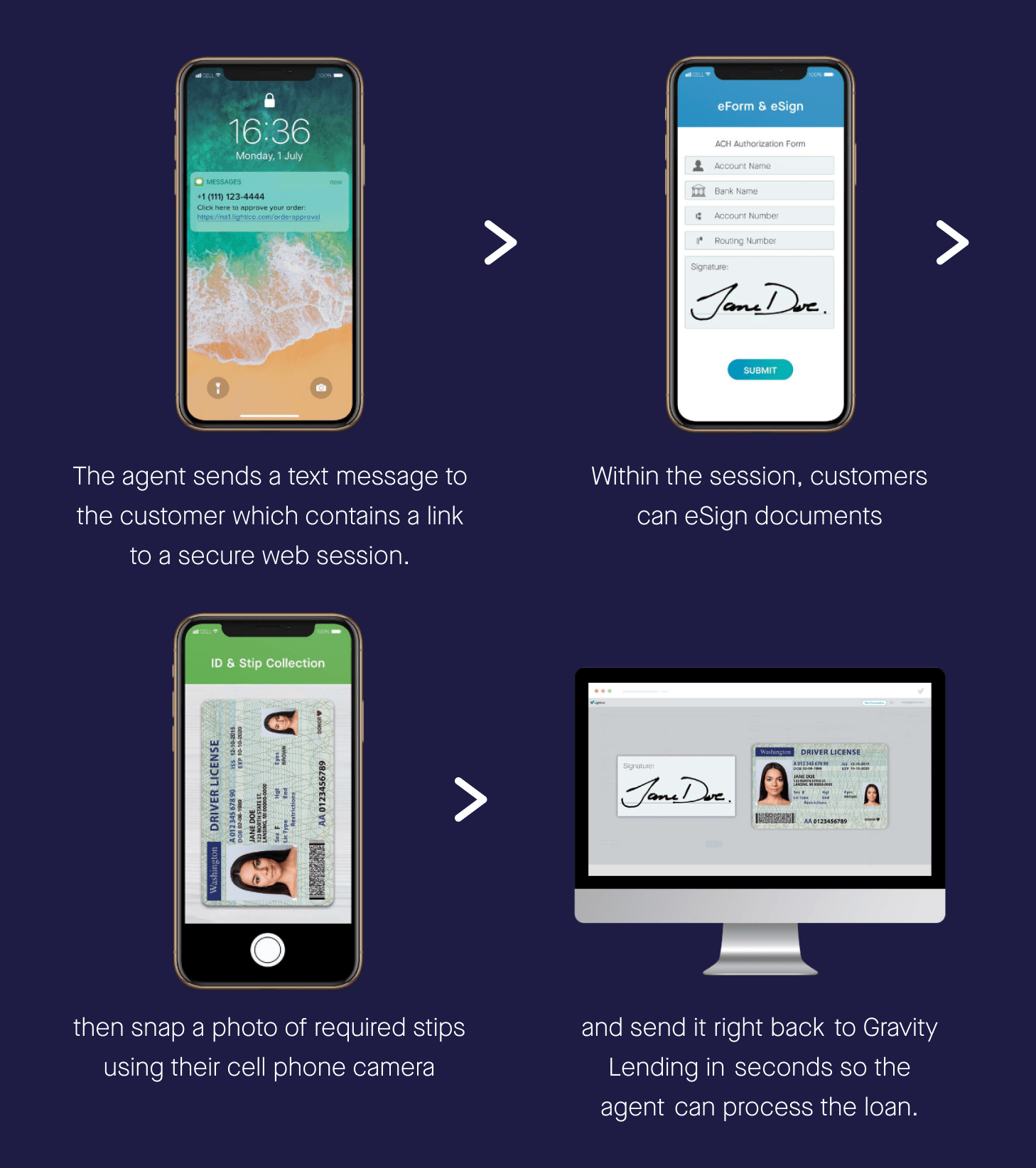

Lightico was implemented in a matter of days. Agents can collect all necessary forms, signatures, documents and stips in real time, while they are on the phone with the customer via a simple, secure text message to the customer’s phone.

Both the agent and customer interfaces are fast, intuitive and simple to use. As a result, loans are funded quickly and efficiently, staff have higher morale, and almost all customer reviews are five-star.

Being able to complete the entire eSignature and stip collection process easily and intuitively on the phone has really created an unbelievable customer experience for us. Almost all of our customer reviews are five-star.

How it Works

Gravity Lending’s Process

Once the customer has completed their loan application online, they receive a call from a Gravity Lending agent to complete their application.

Business Impact

400% Business Growth

Thanks to the speed and intuitiveness of Lightico’s solution, Gravity Lending has experienced 400% growth in 2020, even with all staff working remotely.

Despite the pandemic hitting during their second year of business, the company has been able to continue to serve all customers over the phone with the highest level of efficiency and service and continues to receive hundreds of five-star customer reviews.

We love Lightico’s technology. We’ve experienced tremendous growth, which would not have been possible without Lightico.