Auto Finance at a Turning Point

Falling interest rates are set to unleash a surge in both new loan applications and refinancing requests. Auto lenders who rely on manual, paper-heavy processes will struggle with bottlenecks, compliance gaps, and dissatisfied customers. Those who embrace automation, leveraging AI-Powered Intelligent Document Processing (IDP), will be positioned to scale quickly, protect compliance, and deliver seamless customer experiences. This article explores why demand is accelerating, which five processes lenders should automate now, and how to prepare not just for growth, but for leadership in the next wave of auto finance.

Why Auto Lenders Must Prepare Now

When interest rates fall, demand doesn’t just rise, it accelerates across every corner of auto finance. New customers enter the market looking for affordable financing, while existing customers seize the chance to refinance, restructure payments, or trade in for newer vehicles. The question is not if lenders will see this influx, but whether their processes are built to handle it.

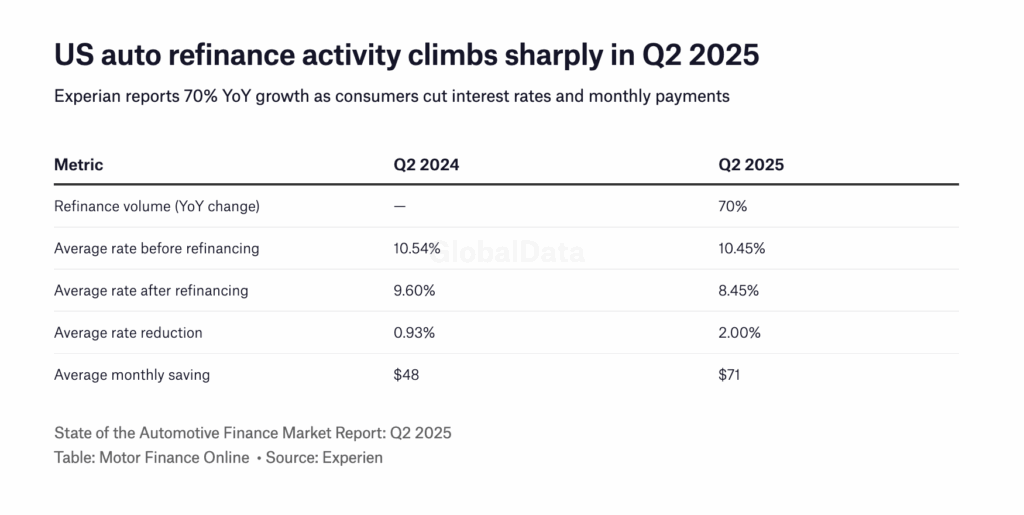

The numbers tell a clear story. U.S. auto loan balances reached $1.66 trillion at the end of Q2 2025, with $188 billion in new auto loans and leases originated in that single quarter, up from $166 billion in Q1 (Federal Reserve Bank of New York). Refinancing activity is also booming: Experian reports that auto refinance volumes jumped 70% year-over-year in Q2 2025, with borrowers reducing their average interest rate by two percentage points and saving about $71 per month on payments (Experian, State of the Automotive Finance Market Report Q2 2025). Even a modest reduction in new loan rates from today’s 7.2% to 7% by late 2025 will only accelerate this trend further.

This creates both opportunity and risk. Lenders who digitize can capture growth, strengthen customer loyalty, and protect margins. Those who remain dependent on manual, paper-heavy processes will quickly run into bottlenecks, longer turnaround times, compliance challenges, and frustrated customers.

That is why forward-thinking lenders are investing in automation. By digitizing core processes such as originations, refinancing, and service requests, and applying tools like AI-powered Intelligent Document Processing (IDP), eSignatures, consent capture, automated approvals, and real-time ID verification, they gain the ability to scale, manage higher volumes with confidence, maintain compliance, and deliver the fast, seamless experiences customers expect. Platforms like Lightico support this shift by providing a no-code way to launch and expand compliant, customer-facing workflows without the burden of lengthy IT projects.

The Accelerating Demand for Digital Auto Finance

This shift comes at a critical time, as affordability is set to improve further. Bankrate’s chief financial analyst predicts that five-year new car loan rates could fall to 7% from 7.53%, while four-year used car financing could drop to 7.75% from 8.21% by the end of the year (Bankrate). Even modest reductions can save borrowers hundreds of dollars annually, making vehicles more accessible across income segments.

But today’s customers, especially Millennials and Gen Z, expect digital-first experiences. They want to apply for financing, upload documents, sign agreements, and get initial approvals all from their phone. Long wait times, printing and scanning paperwork, or multiple calls are dealbreakers.

Unfortunately, many lenders are still stuck with outdated processes: paper contracts, manual ID verification, call-center back-and-forth. These systems are not just inconvenient, they are costly and risky. The transformation is already underway. According to the Wolters Kluwer Auto Finance Digital Transformation Index, digital adoption in auto finance has grown 104.2% over the last four years, with eContracting volume increasing 7.07% from Q1 2025 to Q2 2025, and 9.26% year-over-year.

If lenders do not keep up, they risk losing business to competitors including progressive banks, credit unions, and digital-first lenders who already offer streamlined, mobile-optimized loan journeys.

The 5 Auto Finance Processes You Can Automate Today

To be ready for increased demand, lenders should focus on automating five critical processes. Each of these areas directly impacts both compliance and customer experience, and together they determine whether a borrower completes their loan journey or abandons it.

1. Loan Application Intake

The challenge: Traditional applications are long, confusing, and error-prone. Paper forms require manual data entry, which slows down initial processing and increases the likelihood of mistakes. In a high-demand environment, these bottlenecks cause abandoned applications and frustrated customers.

Automation in action: Mobile-first digital applications streamline the intake process. Customers can fill out forms in minutes, with built-in AI-Powered IDP validation that reduces errors and ensures all required data is captured. APIs feed the data directly into back-end systems, eliminating rekeying and delays.

Example: One U.S. auto lender digitized its loan applications and reduced initial processing time from five days to under 24 hours for pre-approvals. Compliance was strengthened too, since the digital forms ensured every field was complete and audit-ready from the outset.

Impact: Faster initial processing, higher application completion rates, and a better customer experience while reducing operational strain.

2. Identity & Income Verification

The challenge: Manual verification of IDs, pay stubs, and employment information is slow and error-prone. Fraud risk also rises during periods of high demand, straining verification teams and exposing lenders to regulatory risk.

Automation in action: AI-powered document processing can instantly classify and validate submitted documents such as driver's licenses, pay stubs, and tax returns, catching anomalies and verifying authenticity in seconds. Fraudulent applications get flagged early, while legitimate borrowers move through the verification process quickly.

Example: A leading auto finance company implemented automated ID verification and reduced document verification turnaround times from several days to minutes, improving both fraud detection and customer satisfaction.

Impact: Stronger compliance, lower fraud exposure, and faster underwriting decisions.

3. Consent & Disclosures

The challenge: Auto finance is a highly regulated industry. Consent forms and disclosures must be presented, acknowledged, and stored accurately for every loan. Paper-based processes often lead to missing documents, delayed approvals, and audit headaches.

Automation in action: Digital consent capture ensures that every disclosure is presented in a compliant format, with customer acknowledgments captured securely and timestamped. Records are encrypted and instantly retrievable, creating an audit trail regulators trust.

Example: An Indirect auto lender digitized its consent workflows and successfully passed regulatory compliance reviews with comprehensive documentation. Customers appreciated the clarity and simplicity of the digital disclosures, which increased trust in the process.

Impact: Robust compliance without slowing down approvals, greater transparency for customers, and measurable improvements in customer satisfaction—as demonstrated by GM Financial's record-high transactional NPS scores.

4. Document Collection & eSignatures

The challenge: Chasing customers for missing documents or signatures is one of the biggest causes of loan delays. Paper-based signatures and scanned uploads add friction, especially when volumes spike.

Automation in action: With digital workflows, customers can upload documents and sign contracts electronically in real time from any device. This means lenders can finalize applications in a single session, dramatically reducing turnaround times.

Example: Exeter Finance, working with Lightico's digital solutions, successfully converted a significant portion of customers to paperless statements, saving $12 per customer per year while reducing environmental impact. More importantly, automation improved compliance by ensuring all documents were complete and audit-ready.

Impact: Faster loan closures, reduced abandonment, and lower servicing costs while maintaining compliance.

5. Servicing Requests

The challenge: As loan volumes increase, so do servicing needs. Customers request payment extensions, account updates, payoff letters, or hardship accommodations. Manual servicing through call centers leads to long hold times, high costs, and customer dissatisfaction.

Automation in action: Self-service digital workflows allow customers to complete common servicing tasks instantly, securely, and without waiting for an agent. For more complex cases, agents can trigger automated workflows during calls, ensuring the process is completed correctly the first time.

Example: Auto lenders implementing automated servicing workflows have reduced average handle times by eight minutes per call. This freed agents to focus on complex issues, while customers appreciated the speed and convenience of self-service options. GM Financial have experienced their lowest First Call Resolution Rates (FCR) since using Lightico's platform.

Impact: Lower call volumes, faster resolutions, and higher customer satisfaction.

Why Automation Is the Only Scalable Answer

Some lenders may think they can handle demand increases by hiring more staff. But that approach isn't sustainable. Labor is costly, training takes time, and compliance risk grows with manual processes.

Recent market data underscores this challenge: auto loan balances increased by $13 billion in Q2 2025 alone, while auto loan delinquency rates rose substantially to above pre-pandemic levels, with 4.8% of auto loans 90 days or more delinquent in Q4 2024 (Federal Reserve Research). These trends highlight the need for both growth capacity and risk management through better processes.

Automation is the scalable answer. By digitizing customer-facing processes, lenders can:

- Handle higher loan volumes without proportionally adding staff

- Maintain consistent compliance with audit-ready records

- Deliver seamless customer experiences in the moments that matter most

- Improve efficiency, cut operating costs, and boost customer loyalty

In short, automation allows lenders to scale without compromising quality or compliance.

Don't Just Prepare for Growth, Be Ready to Lead It

The auto finance industry continues to evolve rapidly. With interest rate forecasts showing potential declines to more favorable levels by year-end 2025 and customers returning with heightened digital expectations, competition is intensifying. Industry research confirms that 47.8% of financial institutions identify the increasing demand for digital services as the most significant market shift (Ridecell Survey).

Lenders who still rely on manual, paper-heavy workflows risk being overwhelmed by demand and losing customers to faster, more digital competitors. The solution is strategic automation. By digitizing loan applications, verification, disclosures, document collection, and servicing, auto finance companies can capture market opportunities, maintain flawless compliance, and deliver experiences that build lasting customer relationships.

Lightico gives lenders like GM Financial, BMW Financial Services, Westlake Financial, Exeter Financial, Santander, Global Lending Services, Gateway Financial, Bank of America and global banks the tools to automate these critical processes today, positioning them not just to keep up with demand, but to get ahead of it.

Frequently Asked Questions (FAQ)

How will lower interest rates affect auto finance?

Lower interest rates make monthly car payments more affordable, which drives up both new applications and refinancing requests. For lenders, this means higher volumes to process. Without automation, manual document checks and paper-heavy workflows can quickly create bottlenecks. With Intelligent Document Processing (IDP), lenders can automatically validate pay stubs, driver’s licenses, and other documents in real time, ensuring compliance and speed even when volumes surge.

How can auto lenders digitize originations?

Digitizing originations means replacing paper-heavy steps with mobile-first, digital workflows. Customers can apply, upload documents, verify their identity, review disclosures, and sign contracts all in one seamless flow. AI-Powered IDP powers this by classifying and validating submitted documents instantly, cutting out manual “stare and compare” checks and ensuring complete, accurate files before they reach underwriting.

How can auto lenders automate funding processes?

Funding is often delayed by the endess chase for missing or incorrect documents. IDP addresses this by checking every submission in real time, flagging errors or fraud instantly. Combined with eSignatures and consent capture, lenders can complete full loan packages in a single session, reducing cycle times from weeks to minutes and accelerating dealer or customer funding.

What are the biggest risks of not digitizing?

Lenders who rely on manual processes face longer turnaround times, higher abandonment, and compliance exposure. Customers increasingly abandon applications when asked to print, scan, or re-submit documents. Without IDP to catch errors early, lenders risk incomplete files, frustrated customers, and regulatory scrutiny.

Can automation still ensure compliance?

Yes. With Lightico, compliance is built into every workflow. Each consent, signature, and document is captured securely, encrypted, and audit-ready. IDP enhances this by automatically validating critical fields and ensuring documents meet regulatory standards, eliminating human error and reducing audit risk.

How quickly can lenders go live with automation?

Traditional IT projects can take months or years (Digital Paralysis) , but no-code platforms like Lightico enable lenders to launch compliant workflows in weeks. IDP reduces reliance on manual back-office reviews, speeding up implementation and time to value. Many Lightico customers see ROI within the first quarter.

How does automation improve customer experience?

Customers expect speed and transparency. Automation removes friction like scanning and faxing, allowing borrowers to complete their loan in minutes on their phone. With IDP, document-related delays disappear, as errors are caught instantly and approvals move forward without repeated back-and-forth. This builds trust and increases satisfaction.

Does automation help reduce costs?

Yes. By automating document collection, verification, and servicing, lenders reduce manual labor, call center volume, and errors that drive up costs. IDP further lowers expenses by eliminating the need for manual document review, delivering both operational savings and faster time-to-funding.